What business finance intermediaries are telling us about CBILS funding

ThinCats surveyed over 100 professional corporate finance advisers, brokers and accountants to ascertain their views on the Coronavirus Business Interruption Loan Scheme (CBILS).

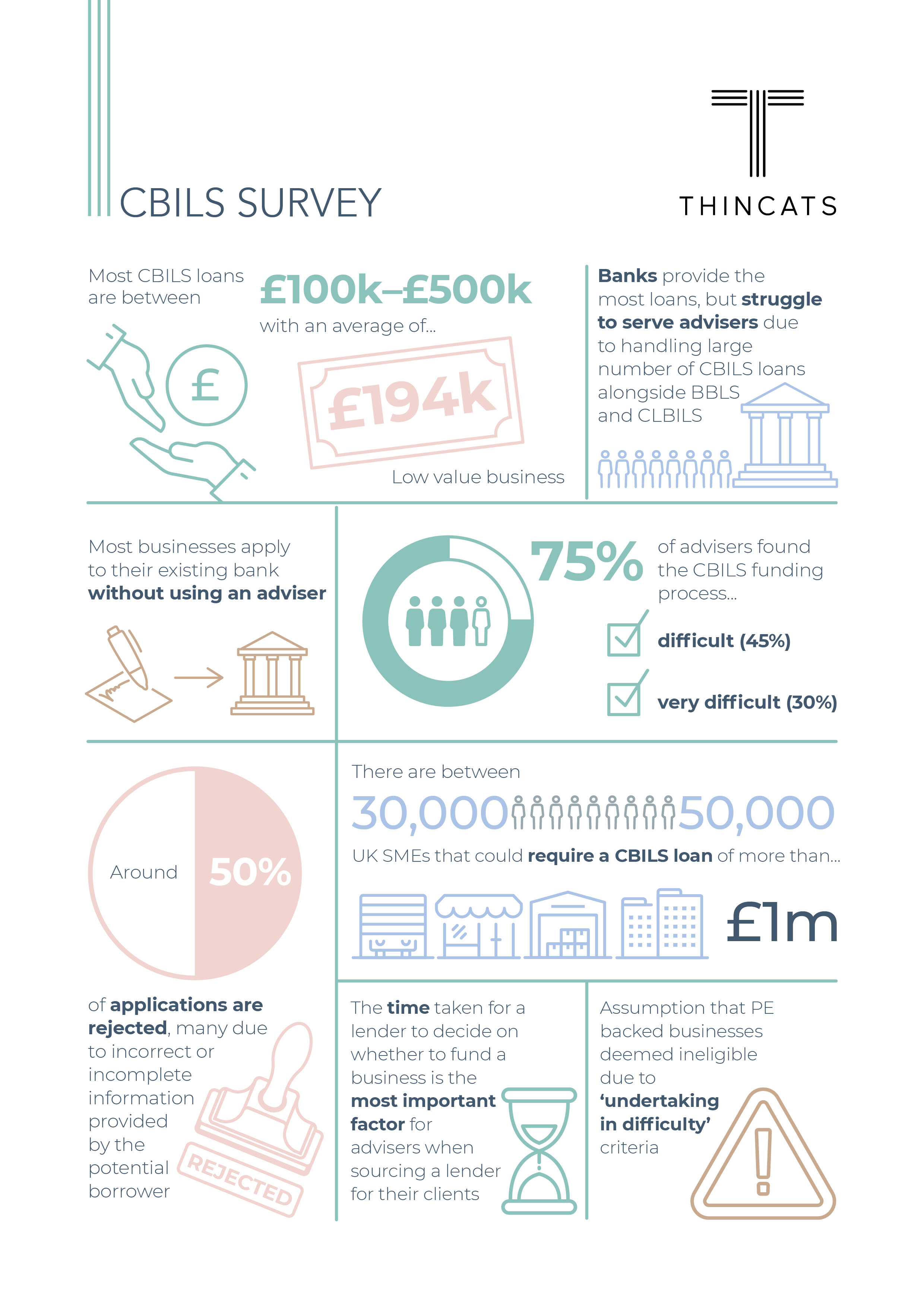

We found that the majority of CBILS loans are between £100-£500k, with an average loan size of £195k. Banks have been providing the vast majority of these loans but have been struggling to serve advisers satisfactorily. Three quarters of advisers found the CBILS funding process difficult (45%) or very difficult (30%), and stated that the time taken for a lender to decide on whether to fund a business is the most important factor for them when sourcing a lender for their clients.

Most businesses apply to their existing bank without using an adviser, but find that around 50% of applications are rejected, many due to incorrect or incomplete information provided by the potential borrower. This is why we recommend that businesses use a business finance adviser who can find the most appropriate lender for their needs and help guide them through the funding process.

When asked how they would improve CBILS, a number of advisers mentioned that private equity (PE) backed businesses should be included, highlighting a potential misconception. PE backed businesses are eligible, however, some may fall foul of the “undertaking in difficulty” definition relating to accumulated losses being more than 50% of subscribed share capital. This can exclude some high growth businesses, although it does not apply if the business is less than three years old.

The accounting treatment of instruments such as loan notes in the calculation of share capital can also have an impact on whether a business is eligible. At ThinCats we have a specialist PE team who can advise on issues of eligibility.

Since extending our CBILS lending to new borrowers we have had enquiries from advisers asking if acquisitions are eligible for CBILS funding. The answer is “yes” as long as the business meets the British Business Bank (BBB) eligibility requirements. In fact, based on our experiencing supporting existing customers, and now new borrowers with CBILS loans, we have found that we can fund pretty much everything we normally would other than MBOs and MBIs.