ThinCats leads switch from clearing banks as main source of M&A funding for mid-sized businesses

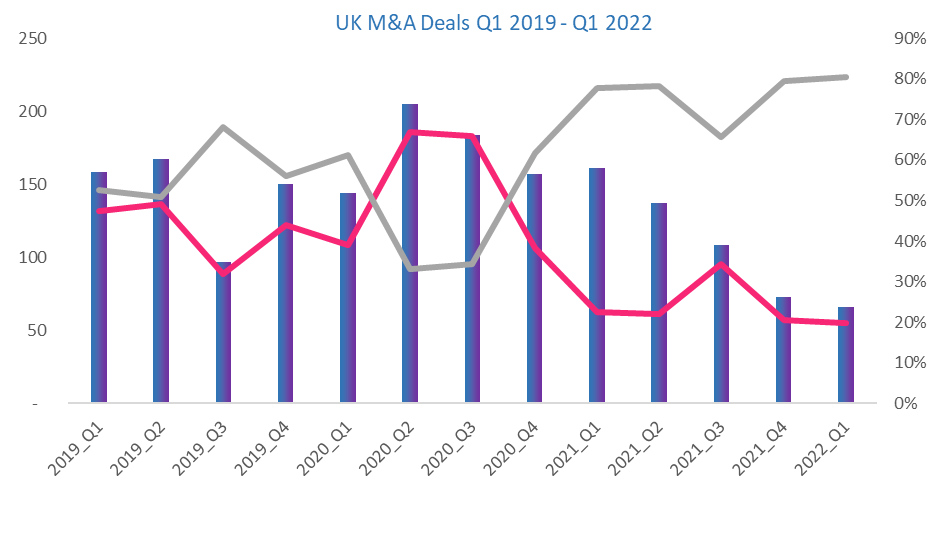

Looking at data covering 13 quarters from Q1 2019 to Q1 2022 the analysis revealed that for deals involving external debt, the proportion of deals where debt was provided by one of the big five clearing banks had fallen from around 50% in the first half of 2019 to less than 25% by early 2022.

The chart shows the number of M&A transactions involving external debt and the proportion of deals funded by either the big five banks or by alternative lenders which includes challenger banks.

Red line – Big 5 clearing banks

Grey line - Alternative lenders

Source: Experian UK deals from £0.5m to £50m where bank debt was involved

I am particularly delighted that over this period ThinCats has provided funding for more deals to mid-sized business than any other alternative lender or challenger bank, confirming our commitment to helping many fantastic UK mid-sized businesses access the funding they deserve

Ravi Anand, Managing Director, ThinCats