PE and technology continue to drive M&A activity

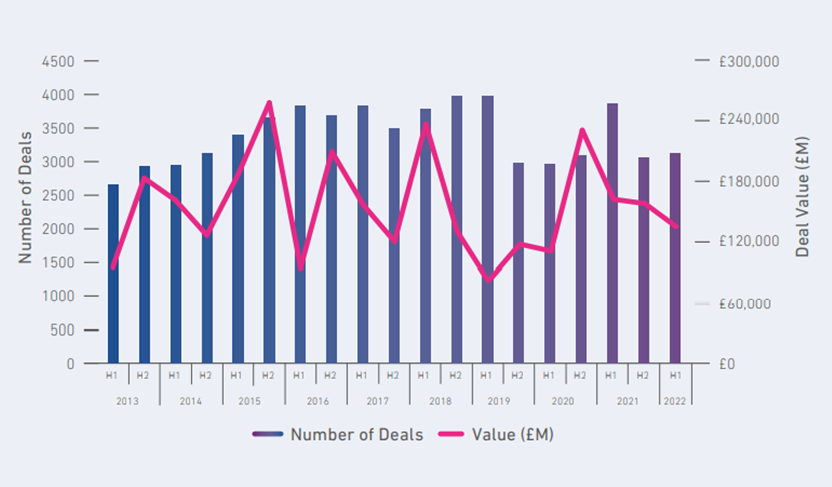

Overall, Experian reports UK M&A deal volumes and values are down 19% and 16% respectively compared to the first half of 2021. This is hardly surprising given the covid-induced pent-up demand from 2020 which was released in early 2021 resulting in higher than usual transaction volumes. Furthermore, macroeconomic headwinds – including the impact of Russia’s invasion of Ukraine – have strengthened in 2022 leading to increased caution that has either delayed or cancelled planned transactions.

Despite a reduction in M&A activity, two themes that jump out from the data are the higher proportion of private equity backed deals and the continuing high number of transactions in the technology sector.

Private Equity

While private equity funding was involved in 27% of H1 2022 deals by number, compared to 23% for H1 2021, the value of that funding soared by 51% to account for more than half the value of all deals – up from 27% of the total value in the first six months of 2021. The managers of private equity funds clearly have plenty of money that still needs to be deployed.

From our experience providing debt funding to lower mid-market PE investors, we expect demand to continue at a similar level throughout the rest of this year.

Technology

In H1 2021 technology was the sector with the most M&A activity and this was repeated in H1 2022, accounting for 29% of overall deal volume and 22% of overall value. Accelerated by the covid pandemic, digital transformation has become a top priority for many businesses resulting in huge opportunities for technology companies that provide the services and products to facilitate this. Increasing the UK’s investment in technology is also recognised as an important contributor to solving the productivity puzzle which continues to restrain economic growth.

Although ThinCats funds businesses across the whole technology spectrum, there are some technology subsectors that are particularly well-matched to our lending approach. These are typically software businesses (independent software vendors or software channel partners) and managed service providers (IT and comms). The findings from the M&A report support our view that funding demand from mid-sized businesses operating in the technology sector will continue to be strong.

The rise of alternative lenders continues

In terms of the source of debt used for the M&A transactions completed during H1 2021, the switch from traditional lenders to alternatives continued with only 4 of the big 5 clearing banks appearing in the top 10 compared to all 5 in 2021. ThinCats continued to rank as a top 10 debt provider for the whole of the UK achieving top spot alongside HSBC in the Yorkshire & Humber region.

*Source: Experian Market IQ https://www.experian.co.uk/content/dam/marketing/uki/uk/en/pdf/2022-H1-Market-IQ-Report.pdf

Prospects for M&A activity for the rest of 2022

The Experian Market IQ report does not make any predictions about future levels of M&A deal activity. From conversations we are having with corporate finance advisers and PE investors right across the UK, current pipelines – certainly until the year end – continue to look strong with some advisers experiencing record volumes of activity.

It is clear, however, that levels of uncertainty have increased throughout the year as macro factors including rising interest rates have added to existing concerns about rising energy and input costs, supply chain issues and staff shortages.

One of the impacts of increased economic uncertainty has been the need to do extra due diligence and sensitivity analysis, especially for businesses exposed to consumer discretionary spending. This has led to an extension in the time needed to complete deals.

Looking into 2023, advisers have less visibility over their pipelines, so are understandably more cautious. It remains to be seen the extent of any additional economic challenges caused by the recent mini-budget announcement, however, we would expect the high proportion of PE funded transactions and M&A activity in the technology sector to continue.

Advisers also tell us that the credit appetite of some traditional business lenders has already reduced, which may further accelerate the move towards recommending more alternative lenders such as ThinCats.