Funding technology businesses could be key to solving UK productivity puzzle

UK productivity puzzle

The UK’s productivity continues to lag behind other international peers including the USA, Germany and France.* Often referred to as the “productivity puzzle” by academics and economists, there appears to be no silver bullet to improving the UK’s international competitiveness. A combination of inadequate investment, vocational skills, infrastructure and growth capital are often cited as the main causes, although it’s widely acknowledged that technology has an important role to play as part of the solution.

As a funder of businesses across all sectors of the UK economy, we saw how the covid pandemic was a catalyst for many businesses to accelerate their investment in technology, with knock-on benefits for the UK’s technology sector, particularly those operating in the B2B space.

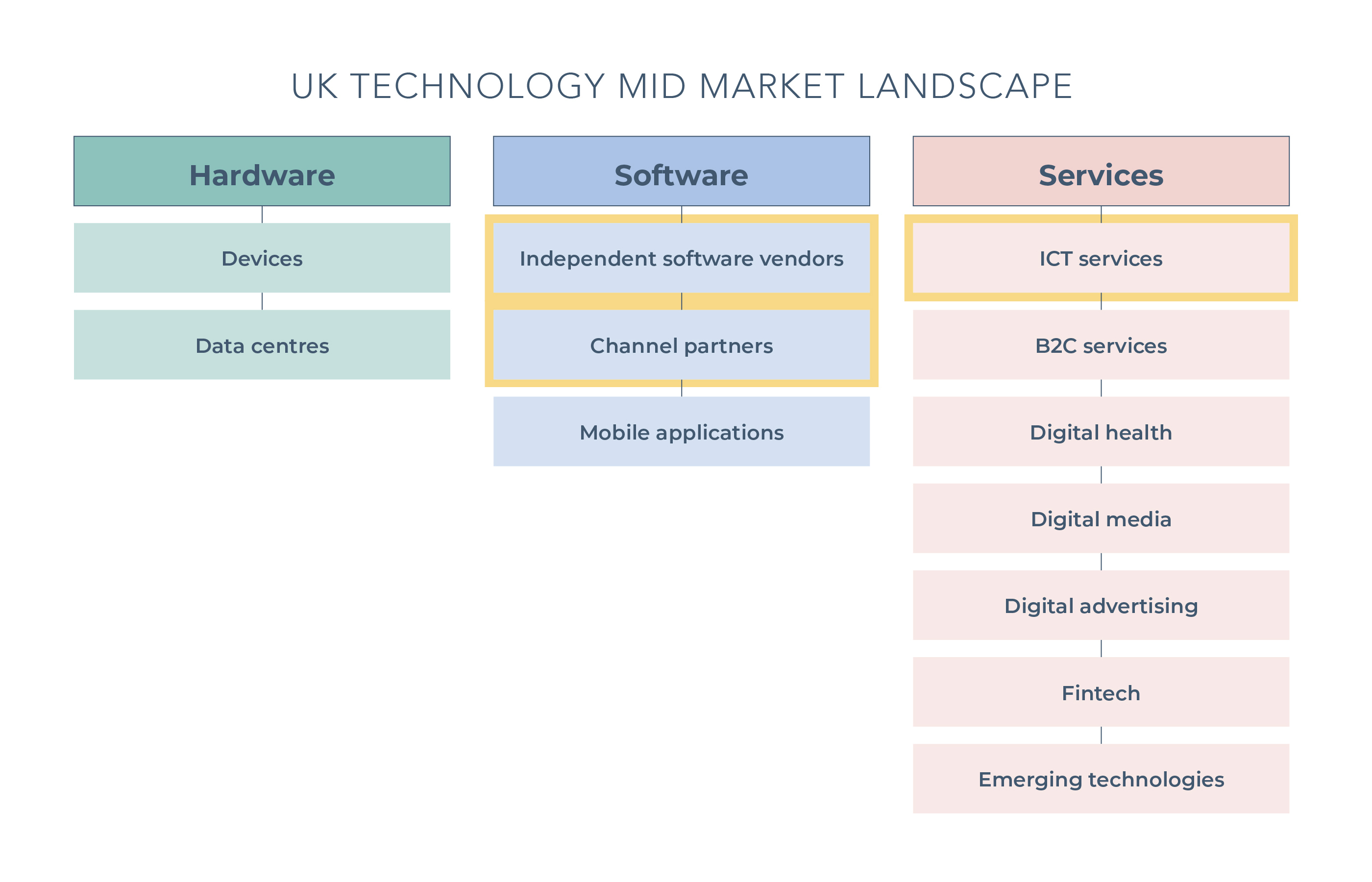

Against this backdrop, we recently carried out in-depth research on the UK technology business landscape. Although we have already provided funding of more than £100 million to technology businesses, we wanted to identify which specific technology subsectors are best placed to benefit from ThinCats’ funding approach. Our research focused on mid-sized technology businesses classifying them into three core sectors; Hardware, Software and Services.

Of the 12 subsectors, the ones highlighted have the highest growth rates, margin profiles and quality of earnings. They also contain higher numbers of businesses and M&A activity compared to other subsectors.

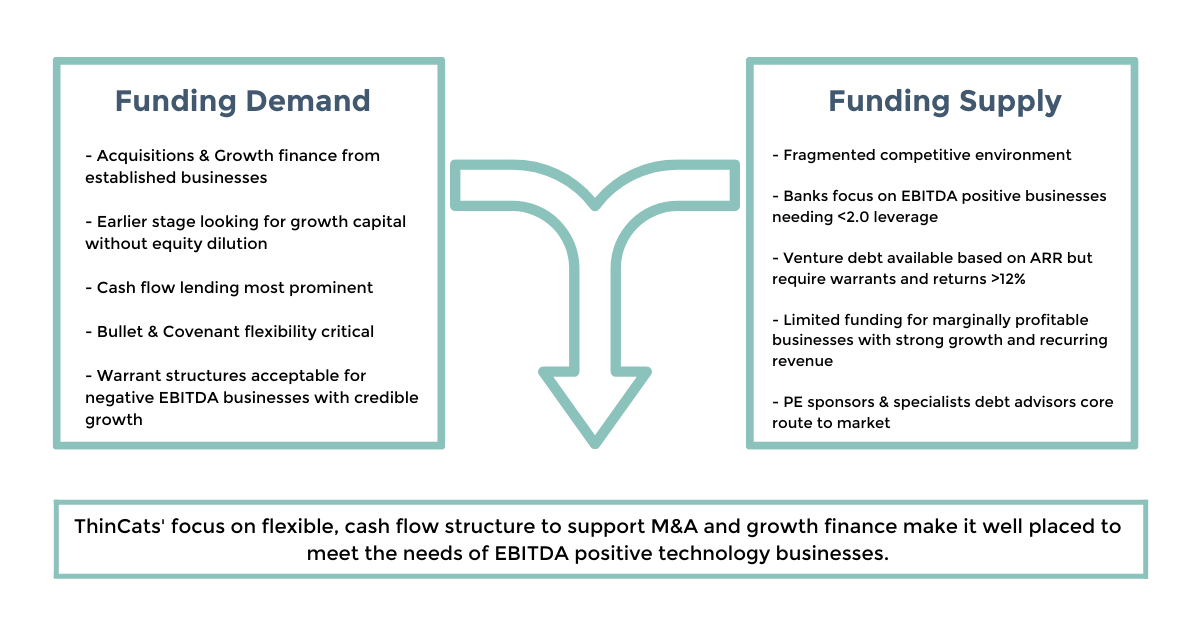

Funding dynamics of the technology sector

When looking at the funding dynamics of the technology sector, the capacity for a cash flow lender, such as ThinCats, to increase the supply of funding is clear.

When looking at the funding dynamics of the technology sector, the capacity for a cash flow lender, such as ThinCats, to increase the supply of funding is clear.

ThinCats favour businesses that can demonstrate:

- Strong B2B earnings from low customer churn

- High recurring contracts

- Ability to offer complementary services

- Strong M&A potential

- Experienced management team

We always assess prospective borrowers based on their individual merits, rather than the sector in which they operate and this remains true across the Technology sector. However, in assessing ThinCats’ capabilities against the dynamics of technology subsectors, we identified four that are particularly well matched to ThinCats’ funding proposition: Independent Software Vendors, Software Vendor Channel partners, IT Managed Services and Comms Managed Services.

Independent Software Vendors (ISVs)

• Forecast to grow at 5.7% CAGR 21-26

• ‘Bounded’ market (e.g. specific vertical, country) or wrap services around the software

• Growth driven through adoption of SaaS solutions

• Demand for SaaS accelerated due to pandemic

Channel Partners

• Forecast to grow at 5.7% CAGR 21-26

• Provide support and hosting services for major software vendors e.g. Microsoft, SAP.

• Digital transformation tailwinds drive the market

• Vendors reliant on channel partners as critical route to market

IT Managed Services

• Forecast to grow at 8.5% CAGR 21-26

• Attractive for lending to finance buy-and-build to expand capabilities

• Digital transformation tailwinds accelerated by pandemic

• Value shifting to cloud, data and cyber.

Comms Managed Services

• Similar to IT MSP but for communications (incl. Unified Comms) & connectivity

• Market growth linked to high demand for bandwidth and voice and video calls

• Work-from-home has increased need for communication managed services and related security

• Mid-sized SMEs gaining traction through after sales service offerings

ThinCats Technology lending criteria and appetite |

|

| AMOUNT

|

£1-15M, with follow-on capital available. Committed facilities and revolver available |

| PURPOSE

|

Acquisition / Buy-out / Growth-Capital / Transitional Capital / Share Capital Clean Up / Refi |

| LEVERAGE

|

On underlying / adjusted EBITDA up to 4X |

| MATURITY

|

Up to 5 years |

| SECURITY

|

Floating charge / Cash flow, no warrants |

| TYPICAL COVENANTS

|

Minimum Liquidity, Minimum EBITDA, ARR Control / permitted acquisition regimes |

Our experience of funding increasing numbers of technology businesses means our sector knowledge ensures we can quickly express our initial appetite and structure loans which suit the dynamics of the business to ultimately deliver a speedy and transparent funding process.

Through our support of technology businesses, we are not only helping to fund their own growth, but also providing access for their customers to invest in productivity improvements, which benefits the wider economy.

*Source: House of Commons Library https://commonslibrary.parliament.uk/research-briefings/sn02791/